33+ credit scores for mortgage rates

580 with 35 down payment USDA loans. However if the borrower applied for the same mortgage with a credit score of 680 the mortgage rate would likely increase due to the score which indicates more risk than a borrower with a 780 score.

The Real Cost Of A Lower Credit Score Chatelaine

ARM FHA 30 Yr.

. Web On paper mortgages backed by the Federal Housing Administration otherwise known as FHA loans allow a minimum credit score of 500 so long as youre making a 10 down payment. Web The best mortgage rates generally apply to those with a solid credit history that demonstrate responsible management of debt. Web The average interest rate for the most popular 30-year fixed mortgage ended January at 613 according to Freddie Mac while the average monthly mortgage payment is currently 3048 for a.

Web When it comes to getting a mortgage a score of 750 or higher may impress lendersbut your credit score is not the only thing that impacts your approval and what your interest rate will be. Mortgage interest rates are constantly fluctuating and even if theyve recently made a significant shift upward chances are that theyll come down again at some point. APR of 5132 with a monthly payment of 1090.

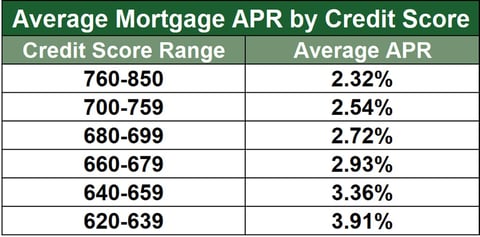

Interest rates are based on many factors including where the home is located and the type of mortgage you apply for. A score of 740 or higher is generally considered excellent credit. If youre planning to refinance todays.

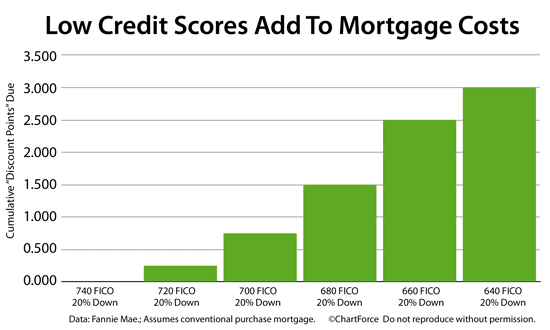

So lenders will look at the range in which your score falls and adjust your rate and fees. It last breached 3 in March of 2020 just at the. Web On a 30-year fixed-rate mortgage for 150000 having a credit score of 620 to 639 could cost you tens of thousands of dollars more over 30 years compared to having a credit score of.

In this example the borrower with a 680 credit score has a mortgage payment thats 64 more per month than someone with a 760 credit score. Web With a 780 FICO score the borrower qualifies for a 4 30-year fixed-rate mortgage which translates to 1145 per month. Web Mortgage rates are generally based on your credit tier rather than your exact FICO score.

Whats the payment on a 133 loan. Web Enter a 200000 principal on a 30-year fixed-rate loan and your credit score ranges mortgage rates and overall costs might look something like this as of July 2022. But if youre making a down payment of 20 or more.

Web With a slightly higher interest rate of 55 you would pay 28189091 over 30 years reflecting a difference of nearly 14000. 500 with 10 down payment. The total interest paid on the mortgage would be 192341.

If you didnt have a great credit score and were only able to. 1 760 to 850. Web Your FICO score named for the Fair Isaac Corporation will range from 300 to 850 with higher numbers reflecting good credit.

Web Get a custom mortgage rate estimate here. The minimum credit score to buy a house with a conventional loan is 620 to 660. The VA has no minimum limit but lenders.

A typical mortgage is 30 years but this calculator can be used for any loan such as a car loan often 3 4 or 5 years business land contract etc. According to Experian bad credit is any score below 580 though the scores can be broken down as follows. Web Personalize your quotes and see mortgage rates just for you.

Web You could pay more than 31000 in extra interest per 100000 borrowed if your score is very low compared to very high. Web Based on the current 15-year mortgage rate average 525 below are expected monthly payments for a home purchase based on a down payment amount. Click on the monthly payment to view the total interest and amortization schedule.

Web Loan Type. Web Speak with a lender and get several quotes to find the best rates. Web Broadly speaking a credit score of 720 or better makes conventional loans optimal while scores between 680 and 720 may find favorable loan terms in conventional or FHA and below 680 or borrowers with less than 10 down will likely find the best terms in FHA loans.

Type the loan amount interest rates and length into the calculator. Its recommended that homebuyers have a credit score of at least 670. Displaying Todays Mortgage Rates for a 320000 Refinance loan.

Even dropping down just one score range could cost more than 4000 in. Home Price 0 Down 10 Down 20 Down. Web Creditors set their own standards for what constitutes an acceptable score but these are general guidelines.

Web If you plan to put less than 20 down on your new home purchase youll need a 760 credit score to get the lowest PMI and mortgage rates. A credit score of 760 or more is typically considered a very good credit score and should allow the borrower access to the lowest available rates. But depending on your financial behavior credit scores can change quite dramatically from month to month and certainly.

Web Check your credit score and credit report to assess your current standing and to identify areas where you can improve. Web FYI the average rate on 15-year fixed-rate mortgages popular among those refinancing their homes rose to 315 from 293 one week earlier. Web When it comes to securing a mortgage a credit score that falls into the commonly acknowledged ranges of Good Very Good and Exceptional will almost always open doors for you when it comes to loan eligibility and attractive rates.

While its impossible to predict when. Web For today Monday February 13 2023 the current average rate for a 30-year fixed mortgage is 666 up 20 basis points since the same time last week.

Average Mortgage Interest Rate By Credit Score And Year

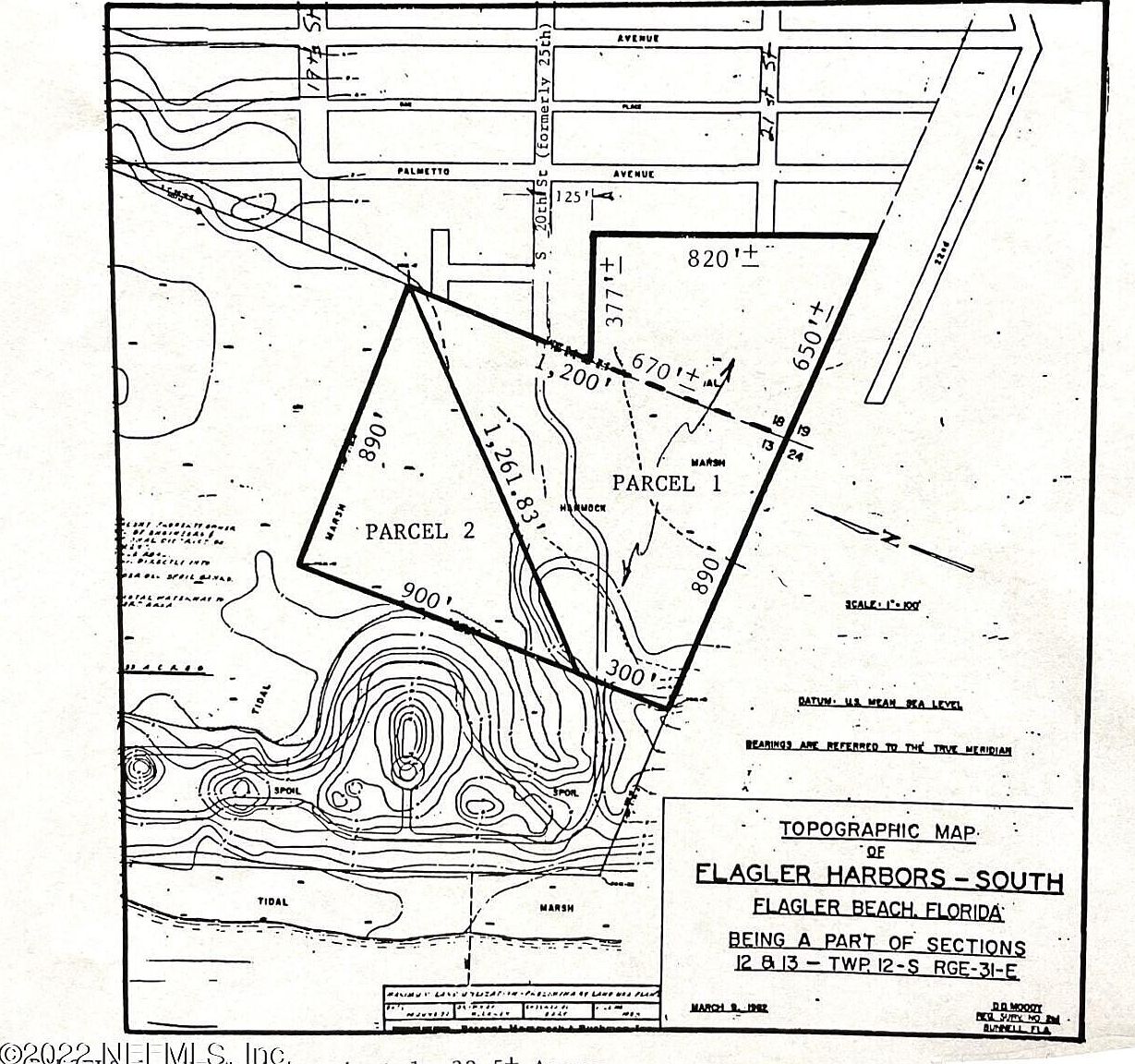

0 20th St S Flagler Beach Fl 32136 Mls 1197575 Zillow

How Credit Scores Affect Your Mortgage Rate

Open Esds

How Credit Score Affects Your Mortgage Rate Big Valley Mortgage

How To Check Your Credit Score Rating Propertynest

Ex 99 1

Thoughtskoto

How Does A Credit Score Affect Your Mortgage Rate Credit Absolute

Credit Score Needed To Get The Best Mortgage Rate Possible 800

:max_bytes(150000):strip_icc()/WhatisaMortgage-56c66a815f9b5879cc3e2d34.jpg)

Mortgage Rates By Credit Score

Credit Score Under 740 Prepare To Overpay On Your Mortgage

Mortgage Rates Today For Good Great And Excellent Credit Scores Advisoryhq

Zillow Credit Score Single Most Important Factor For Mortgage Rates

G400311mmi003 Gif

The Average Credit Score For Approved Mortgages Is Declining

15 Credit Score Charts Data Trends 2023 Badcredit Org